Why is bamboo toilet paper from China still competitive in the US market despite high tariffs?

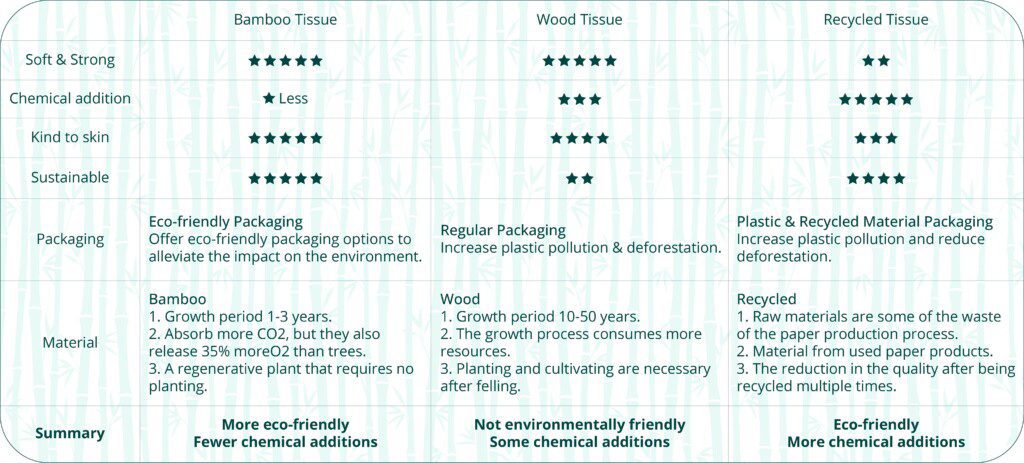

Despite high tariffs, Chinese bamboo toilet paper remains competitive due to growing US demand for eco-friendly products, limited local bamboo resources, and China’s established supply chain. US consumers, especially in the mid-to-high-end segment, are willing to pay a premium for sustainable paper products.

1. Rising Demand and Environmental Awareness

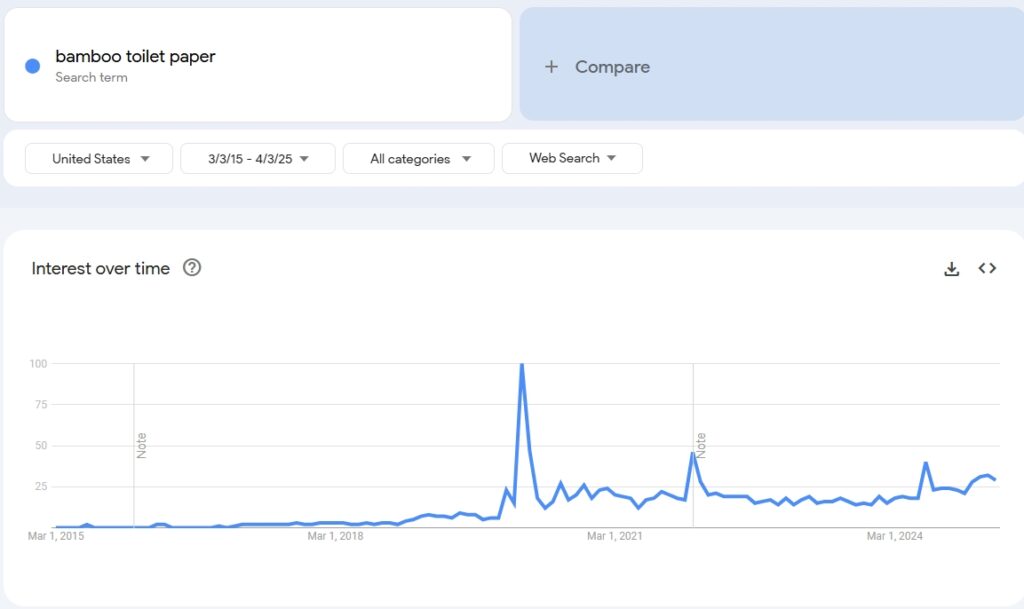

Since the initial 25% tariff imposed in March 2018, the cost pressure on imported bamboo paper has increased. However, with rising global awareness of sustainability, more consumers are paying attention to the environmental impact and sourcing of products. Bamboo tissue rolls, as an eco-friendly and sustainable alternative, are gradually gaining market recognition.

In the US, bamboo toilet paper is moving from niche to mainstream, as consumers recognize its environmental advantages and premium quality. According to Google Trends data, from 2018 to 2024, the search volume for “bamboo toilet paper” has continued to grow. This indicates that even with rising prices, consumers are willing to pay a premium for sustainable, high-quality products.

Notably, US middle- to high-income consumers show significant price tolerance—Nielsen research suggests that the premium acceptance rate for eco-labeled products is between 28% and 35%. This consumption upgrade trend is pushing bamboo household tissue paper into more mainstream channels.

2. Limited Bamboo Resources in the US

Although the US is promoting domestic manufacturing, setting up bamboo paper production plants in the US is not feasible due to the lack of bamboo forest resources needed for large-scale production. The industry still relies on imported bamboo pulp boards—mostly from China—which are also subject to high tariffs. This approach fails to reduce the cost of eco-friendly bamboo tissue products.

3. Balanced Dynamics in Supply Chain Restructuring

Currently, the US tissue paper market shows a dual-structured supply model: domestic production dominates about 82% of the market, while imports from countries like Canada account for around 10%. Chinese bamboo tissue products hold an estimated 3.5% market share but are growing rapidly.

Data shows that the US heavily relies on imported wood pulp. Domestic wood pulp-based tissue producers are also under pressure due to rising raw material costs.

In the short term, eco-conscious bamboo bathroom tissue may face pricing pressure due to tariffs. However, price increases do not necessarily lead to a loss in market share, especially among environmentally conscious consumers. Household tissue is a daily necessity, and sustainable bamboo tissue is not highly price-sensitive. Consumers are unlikely to switch to cheaper recycled or wood pulp-based products solely due to price.

Over time, the price gap between bamboo-based tissue and conventional tissue is expected to narrow. As a niche segment, bamboo tissue is likely to continue expanding in the US market.

4. Spillover Effects of US Manufacturing Policies

Since the beginning of Trump’s second term, the US government has adopted a series of policies encouraging manufacturing reshoring, including tax reductions and subsidies, along with high import tariffs to protect domestic industries.

Several global tech giants have responded by announcing large-scale investments:

- Apple plans to invest $500 billion in building new factories in the US;

- SoftBank, led by Masayoshi Son, pledged $100 billion for US manufacturing initiatives;

- TSMC and Microsoft are building production bases focused on AI and semiconductors.

These policies aim to boost manufacturing, employment, and wages. If successful, they will increase the purchasing power of the middle class and further stimulate demand for high-quality, eco-friendly products—a positive signal for the bamboo tissue sector.

Conclusion: Finding Opportunities Amid Tariffs

Although the tariff policy under the Trump administration has created short-term challenges for bamboo paper imports, long-term opportunities remain strong. The US cannot completely replace imported bamboo pulp, making local production unfeasible. At the same time, growing environmental awareness and rising incomes will support the demand for bamboo toilet paper and related eco-paper products.

As a Chinese exporter, I remain confident in the market’s future. By continuing to improve product quality, certifications, and service, we can position ourselves to capture the growing potential of eco-conscious paper product markets.

FAQ: Bamboo Toilet Paper and the US Marketeco-conscious alternative.

Q1: Is bamboo toilet paper a viable product for the US market despite high tariffs?

A1: Yes. Environmental awareness among US consumers is increasing, and they are willing to pay more for sustainable options, including bamboo toilet paper.

Q2: Why not produce bamboo toilet paper locally in the US?

A2: The US lacks large-scale bamboo resources. Even if factories are built, they would need to import bamboo pulp from abroad, which is still subject to tariffs.

Q3: Will the tariff reduce consumer demand for bamboo tissue?

A3: Unlikely. Bamboo tissue appeals to middle- and upper-income consumers who are less sensitive to price and prioritize sustainability.

Q4: What gives Chinese bamboo tissue an advantage?

A4: Mature supply chains, access to raw bamboo, strong OEM/ODM capabilities, and increasing product certification FSC make Chinese suppliers globally competitive.

Q5: How can exporters respond to the trade environment?

A5: Focus on product quality, brand building, and fast delivery. Position bamboo-based tissue as a premium, eco-conscious alternative.